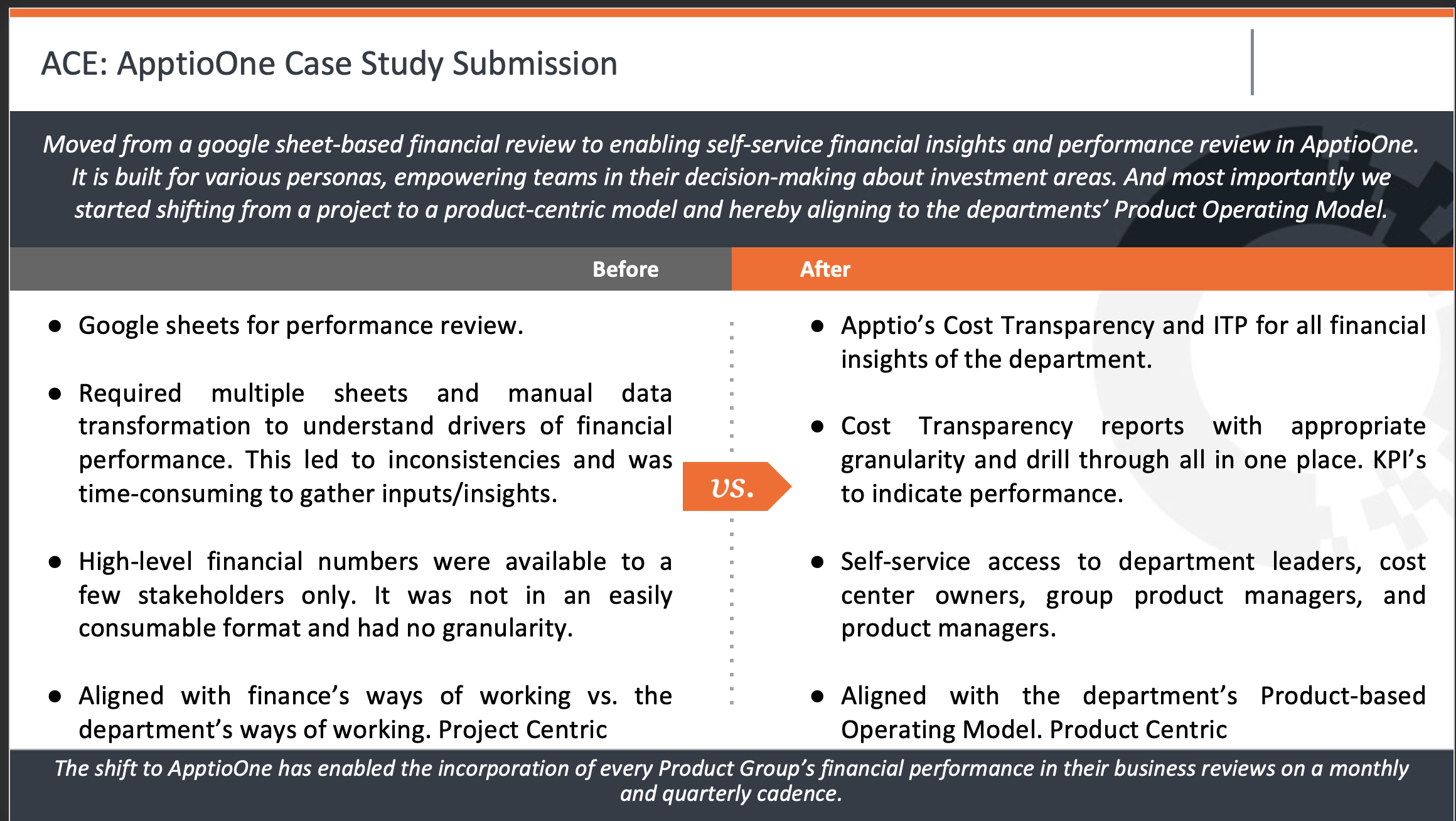

This particular use case is one of TBMO driving business value by introducing financial transparency to our IT leaders and product managers. In the process, we moved from a project-centric to a product-centric insights model.

Goals

We set ourselves a goal of enabling automated & self-service financial insights leveraging existing systems of record, for our Leaders and product teams, across IT. Considering we relied on google sheets for our performance reviews before this, it was a big step forward.

Milestones

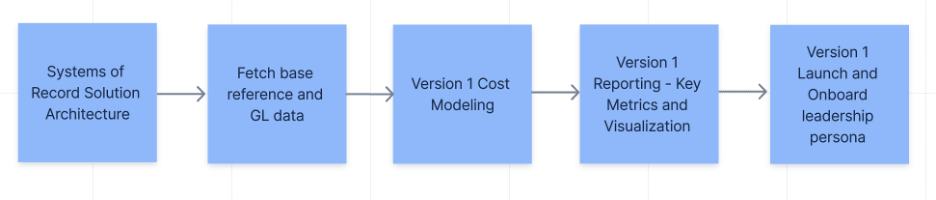

We approached this in a two-step process:

- Build the foundational financial model with appropriate granularity aligning with the finance department's way of viewing performance. These are Project-centric and Cost center-based insights. Step 1 is critical to getting the data accuracy right (finance would help validate this) and winning our customers' trust.

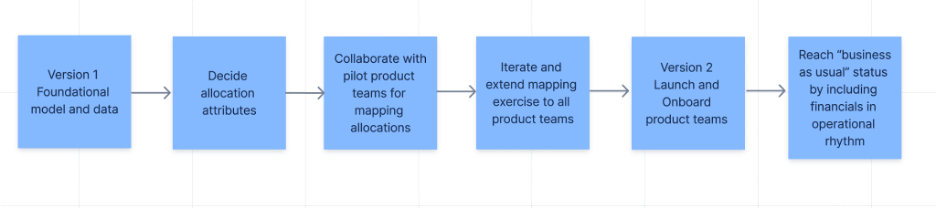

- Once we completed step 1, we ramped up to build the product-centric model. We called this version 2 and onboarded the larger product teams as our customers.

Specifications

I. Foundational Project-centric Financials: Steps followed

II. Product-centric Financials: Steps followed

Challenges

- Since our TBMO had no prior experience with TBM and ApptioOne, getting the project started took time and effort. Some of the questions we initially faced were:

- Which of our internal systems would feed the raw data? For GL, for Budgets/forecasts, contracts, and workforce.

- What departments, accounts, and expense types are we to choose?

- How do we group the accounts for a bigger picture? While still aligned with how finance looks at it internally.

- What is the right level of granularity for each cost pool?

- Getting comfortable with TBM studio and all aspects of CT and ITP

- The next big challenge was onboarding users to utilize the self-service reports.

Results and Current State

- FINANCIAL TRANSPARENCY

- We shifted from Google sheets to automated and tool-based financial performance reviews.

- We saved several hours by moving away from manual data organization and reporting. Tool-based insights also ensured greater accuracy and dependability.

- Insights are now available to the broader team versus restricted to a few stakeholders.

- PRODUCT-CENTRIC

- IT has moved to operate in a product-based model. We could shift our financial insights to a product-centric model by aligning with the same.

- This model helps make investment decisions with a product lens, making it agile.

- 10 product groups utilize the insights for decision-making along with our SBO/TBMO team.

- TBMO is actively collaborating on savings opportunities in software applications (~2%) with the respective product teams.

- REACHING BUSINESS as USUAL for FINANCIAL INSIGHTS

- Financials have become a regular addition (screenshots and highlights are embedded) to many of our product group business reviews. So, we have more people aware of their budgets and where they spend them.

- One continuous area for improvement is onboarding new users and having existing users regularly use the tool.

#ApptioOne

@Debbie Hagen @Sanchit Sabharwal

#ApptioforAll#ACE#TBMStudio