Authors: Kenneth Lim & Steven Hwang (IBM Data Science & AI Elite team)

Claims leakage, or the excess costs incurred by an insurer from processing claims inefficiently, is one of the most pressing concerns for insurers,[1] costing the insurance industry $30B a year. Many insurers experience claims leakage up to 20% higher than the 3% industry benchmark.[2]

Insurers can typically save 5% to 10% of their claims’ costs by reducing claims leakage,2however, they struggle because leakage is traditionally only detected through retrospective audits. This leaves insurers with limited visibility into existing leakage, outdated insights, and large amounts of complex data to navigate when designing an appropriate solution. These pressures are compounded by an increasingly dynamic and uncertain business environment.

Insurance companies can now apply AI to their complex data and reduce claims leakage proactively. Doing this successfully will reduce costs and errors. Claims can also be processed faster by using AI to account for the complexity of claims and the handlers’ skills among other factors. Faster processing of claims means shorter waiting times, which can be a competitive advantage to retain and attract customers who increasingly expect quicker service.[3]

Insurers can reduce claims leakage and increase customer satisfaction with AI using the Claims Leakage Industry Accelerator on IBM Cloud Pak® for Data. The accelerator provides a set of pre-packaged AI assets to predict and minimize potential claims leakage.

Optimizing claim allocation to prevent leakage

The Claims Leakage accelerator predicts potential leakage for each claim and then optimizes the allocation of claims to handlers by accounting for multiple factors. These factors typically contribute to leakage such as the complexity of a claim, the experience and workload of a claim handler, and more.

A sample web application displays the AI results intuitively for a manager who handles the allocation of claims to her team of handlers. The manger can compare the impact of different optimized ‘what-if’ scenarios on the workload of handlers and predicted leakage, allowing her to select the most appropriate solution for the business.

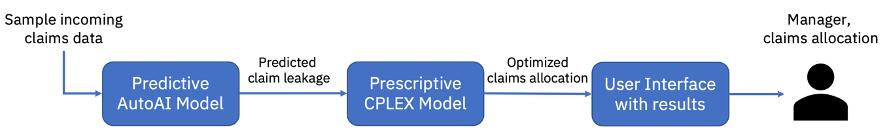

Figure 1 shows the three key aspects of the accelerator solution architecture:

- Leakage is predicted for each incoming claim based on characteristics of the claim and each handler.

- The predicted leakages of the claims are used as an input for a decision optimization model to allocate the claims to different handlers, minimizing the overall leakage cost under four ‘what-if’ scenarios.

- The manager compares and selects the most appropriate allocation scenario from a sample R Shiny® web application.

Figure 1: Claims Leakage accelerator solution overview.

Figure 1: Claims Leakage accelerator solution overview.

Technical details

The model to predict claims leakage was built automatically with the AutoAI capability in Watson Studio, a low-code, no-code software based on technology developed by IBM Research.[4] The AutoAI model can also be initiated with Python, if code is preferred. An Extreme Gradient Boosting (XGBoost) model with automated feature engineering and hyperparameter optimization was selected as the most optimal model for deployment.

The model to optimize the claims allocation was a generalized assignment model built using IBM Decision Optimization technology (CPLEX®). The model chooses to assign each insurance claim to a single handler while minimizing the overall leakage cost. It has a variety of constraints that can be turned on and off, allowing the insurance claims allocation manager to analyze different claims assignment scenarios to best understand the trade-offs on the overall leakage cost. The constraints are:

- Workload balance. This ensures that the claims workload for each handler is similar.

- Maximum workload. This limits the total number of claims that can be assigned to each handler.

- Skill level restriction. This limits the complexity of a claim each handler is allowed to be assigned.

- Number of out-of-skill claims assigned. This limits the number of claims above a handler’s skill level they are allowed to be assigned.

Ramp up with the right expertise

Industry Accelerators on IBM Cloud Pak® for Data provide tools to help you to advance from demonstration to implementation in hours, rather than weeks or even months. Learn how these accelerators can help you expedite your claims leakage strategy by exploring the Accelerator Catalog.

For help getting started, let our experts assist you. The IBM Data Science and AI Elite (DSE) team will work side by side with your team to co-engineer AI solutions and help your business develop a personalization strategy.

References

[1] https://go.forrester.com/blogs/insurance-predictions-2021/

[2] https://www.pwc.com.au/industry/insurance/assets/stopping-the-leaks-jan15.pdf

[3] https://www.actuaries.org.uk/system/files/field/document/Policy%20-%20Data%20Science%20in%20Insurance%20V08.pdf

[4] https://dl.acm.org/doi/10.1145/3379336.3381474

#GlobalAIandDataScience#GlobalDataScience