Sustainability is no longer ‘nice-to-have’

Background & Context

The attention of the world world would again be focused on climate change and environmental concerns, with 27th Conference of the Parties to the United Nations Framework Convention on Climate Change –COP27 - to held from 6-18 November,2022, with the heads of states, ministers, along with climate activists, mayors, civil society representatives and CEOs will meet in the Egyptian coastal city of Sharm el-Sheikh for the largest annual gathering on climate action, with a growing energy crisis, record greenhouse gas concentrations, and increasing extreme weather events, seeking to renewed solidarity between countries, to deliver on the landmark Paris Agreement, for people and the planet.

From the watershed Earth Summit at Rio in 1992 to the adoption by all the United Nations Member states in 2015 of the 2030 agenda for Sustainable Development, the global attention was focused on creating a shared effort for common peace and prosperity for people and prosperity. The centre piece of the 2030 agenda gave the world the much-vaunted 17 Sustainable Development Goals ( SDGs) , which are the blueprint to achieve interlinked goals to achieve global prosperity, progress and equality all the while tackling climate change and preserve our environment for present and future generations.

Source: https://www.un.org/sustainabledevelopment/news/communications-material/

Source: https://www.un.org/sustainabledevelopment/news/communications-material/

The upheaval from the pandemic has crystallised these concerns across all sections of the society globally. Although the Covid-19 pandemic has led to huge financial hardships to all sections of the society globally thereby adversely impact the SDG goals, there is also a growing bottoms-up chorus for new approach to economic activities and business priorities , that look beyond the immediate financial considerations and to tackle the climate-change , environmental damage and change in consumption patterns of our natural resources in delivering the products and services to the people.

Banks at the centre of the sustainability conversation

The signatory governments have put in place specific policies and programs to track and achieve the SDGs. There are global, institutional solution frameworks for policy guidance and SDG assessment, to track the SDG related performance for the member countries . ( Read more at https://www.unsdsn.org/sdg-index-and-monitoring ) Another key area important to achieve the 2030 Agenda for SDG is the re-framing the sustainable development and corporate sustainability that touches all areas of economic activities.

Banks occupy a pivotal position in the modern world in all the financial flows across all economic activities across all the sectors. The banks are in unique position where they are simultaneously able to influence and also exposed to risk , arising out of the financial impact and the SDG related performance of clients across the economic value chain. Thus, the way banks are and will respond to the sustainability challenge has and will have significant impact on the lives of the people and the environment.

Industry Sustainability Frameworks

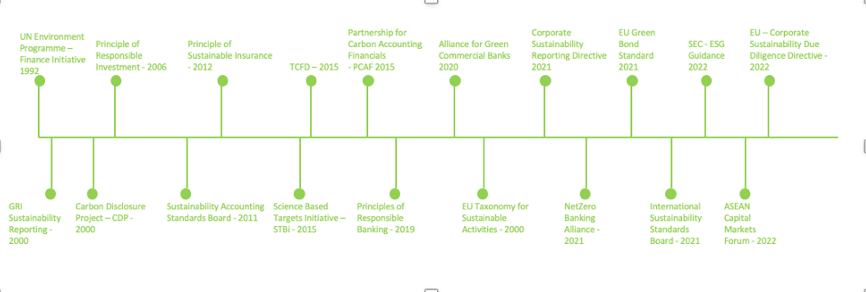

The first organised move in this direction was UNEP Finance Initiative, founded back in 1992, is a large network of banks, insurers and investors that collectively catalyses action across the financial system to deliver more sustainable global economies.

Source: Author's Research

Source: Author's Research

One of the major driver in financial services was investing in sectors and economic activities with significant positive impact on the the SDG goals. The term ESG - Environmental , Social and Governance - was coined in due course , to cover the objective, quantifiable impact and evaluation criteria to measured and reported to gauge the corporates on their activities aligned to the SDG goals.

These industry initiatives have shown the way and now the regional and national banking regulators are looking to put in place disclosure requirements to gain visibility and drive sustainability actions within the banks.

Sustainability is a ‘Must-Have’ for Banks

The banks are facing pressures from all stakeholders - board, investors, ecosystem partners, regulators, government, customers and employees , for greater actions and transparency for sustainability actions. The policy packages introduced by the governments towards achieving their SDG goals and climate targets. The banks have to respond with their own strategies and targets to support the economy to transition to a “Green Economy”

The banks are looking to not just comply and react to the below sustainability drivers, but to make it part of their business growth strategies.

The next part of this blog series will focus on how banks are operationalising sustainability and embed it across their enterprise functions to unlock its true impact and value.