There’s a chance you might’ve already heard about stablecoins. The blockchain-backed cryptocurrencies have been at the forefront of the news for some time now. Facebook announced the launch of its own stablecoin called Libra back in June 2019, in a project that is now regarded as something of a fiasco. At the beginning of 2020, the construction process began in the development of Akon City in Senegal - a 2,000-acre metropolis that’s set to operate entirely on a stablecoin called Akoin (the project was founded by musician Akon).

After entering the public consciousness in 2019, stablecoins look certain to find more limelight in the cryptocurrency world one year on - with their respective accessibility and practicality identified by some as ideal in bringing digital coins away from the world of investment and into daily use.

While the famous cryptocurrencies of today like Bitcoin and Ethereum are driven by intense speculation and investment opportunities, stablecoins are developed in a way that keeps their values secure. This means that it doesn’t make much sense to invest in stablecoins in bull markets, and their primary benefit will be through actual spending. However, this notion is wholly dependant on stablecoins retaining their stability - something that’s highly unusual in the volatile world of crypto.

So what exactly are stablecoins? And are they really as stable as we’re led to believe? Let’s explore the relatively calm world of the stablecoin in a little bit more detail:

What are stablecoins?

Stablecoins are blockchain-based tokens that are developed in a way that pegs their value to real-world assets like the US Dollar or gold in order to maintain a consistent price. Stablecoins work by acting out smart contracts that burn and issue tokens in response to market forces or user redemption.

Naturally, stablecoins fly in the face of typical cryptocurrencies due to their pegged values, but this doesn’t stop traders from showing an interest in them during cryptomarket declines. Typically, investors will choose to escape the falling market by opting to buy stablecoins rather than cashing out into a fiat currency.

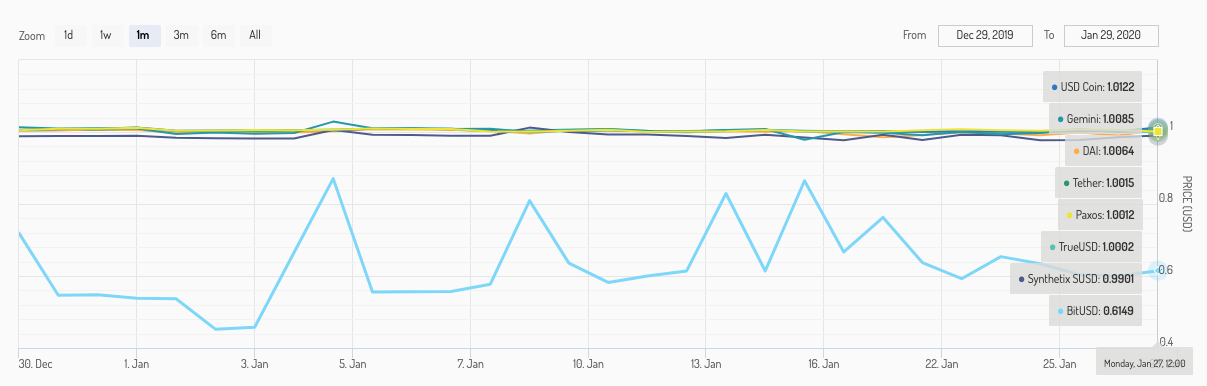

(Stablecoins have generally toed the line in keeping with US Dollar parity. Image: Stablecoin Index)

As we can see in the chart above, stablecoins have maintained their value well, with all but one cryptocurrency remaining within 1/100th in proximity to the US Dollar.

One cryptocurrency, BitUSD, is an early example in how stablecoins can go wrong, however. In the case of BitUSD, the oldest mainstream lost its peg with the Dollar towards the end of 2018 and has since failed to restore its stability.

BitMEX research into the case of BitUSD found that the cryptocurrency has a flawed price stability mechanism due to it only protecting against scenarios where the value of BitShares fall - as opposed to when the value of BitUSD falls. They determined that this rendered the mechanism that holds BitUSD’s peg as nothing more than psychological.

The different types of stablecoin

There are three fundamental types of stablecoin. Centralised IOU stablecoins are the most straightforward version of the digital currency. These coins are supported by fiat money like the US Dollar and precious metals like gold. The reason that centralised IOU stablecoins hold their value is because they act as a representation of an external asset.

Popular IOU stablecoins include TrueUSD (TUSD) and Gemini Dollar (GUSD). Despite the popularity of IOU stablecoins, this form of cryptocurrency has come into criticism over its centralised setup. This means that users need the trust of an issuing party and the scrutiny of regulators in order to make transactions.

Where Centralised IOU stablecoins are backed against tangible real-world assets, crypto-collateralised stablecoins keep their operations firmly in the world of crypto. Coins like Timvi (TMV) operate as crypto-collateralised currency, and are pegged to blockchain-based assets like Ethereum or other popular tokens.

Not all stablecoins feel the need to be collateralised, and non-collateralised coins have been known to function in the world of crypto too.

How is it possible for an uncollateralised entity to operate with a stable price? Impresively, the answer comes in the form of seniorage shares - an idea developed by Robert Sams in 2014. Seniorage shares use smart contracts to mimic the actions of central banks in which there is only one monetary policy obligation: issue currency with a value of exactly $1. This means that the network issues new coins if the price of the stablecoin is deemed too high and burns coins if the price is too low.

CarbonUSD is one of the most popular stablecoins operating on a non-collateralised basis.

Deviations

Where most cryptocurrencies are measured by how much their respective values appreciate, the goal of a successful stablecoin is based around how few deviations occur from their $1 peg.

Coinmonks ran a test in 2019 to explore the rate of coin deviations and find out which stablecoins performed best in terms of remaining stable in the market.

In their 60-day testing timeframe, Coinmonks found that the daily deviation among the market’s most popular stablecoins stood at around $0.02 to $0.03 from their $1.00 peg. This marginal shift in price tends to indicate that there is a generally reliable level of stability in the market. However, the investigation did find that centralised stablecoin Gemini Dollar fluctuated by as much as $0.15 occasionally. While 15 cents doesn’t represent a seismic shift, it must be regarded as a chink in the armour of the stablecoin market.

To conclude their deviation experiment, Coinmonks identified Tether (USDT), Paxos (PAX) and TrueUSD (USDT) as the most stable entrants on to the stablecoin landscape.

Strong and stable future?

So, despite the occasional deviation, and the exception of the ailing BitUSD, it’s fair to say that stability is a common feature among the stablecoin market leaders. This is a good sign for the future, but there will undoubtedly be stern tests on the horizon.

Facebook’s ambitions for its Libra stablecoin were huge. Stablecoins represent a bridge to deprived, unbanked communities worldwide, and can make for a reliable currency in nations that suffer from damaging inflation rates and political unrest.

2020 will go down as a pivotal year in the short history of stablecoins. It’s fair to expect adoption to rise while established cryptocurrency markets continue to fluctuate. The key question if, or when, the adoption of stablecoins begin to snowball will focus on whether or not stability can be sustained when usage continues to rise.

There will also be fresh challenges further down the line based on the values of stablecoins’ pegged assets. How would a global market downturn affect the value of stablecoins? Could centralised IOUs overcome a major change in the value of gold?

Unlike the famous currencies of Bitcoin and Ethereum, stablecoins will be judged on how well they toe the line of US Dollar parity. Any more high-profile cases like BitUSD, and a whole market of potential adopters could be scared off for good.

#TRIRIGA#AssetandFacilitiesManagement