Cryptocurrencies have gained immense popularity in recent years with Bitcoin being the first and most popular peer-to-peer cryptocurrency. Investors see Bitcoin as the next “Gold”(a safe asset for the future) to invest in as there are only a limited amount of Bitcoins. However, the past 12 months have seen both all-time highs and rapid fluctuations for the different indices (DJIA, S&P 500, etc), gold and Bitcoin. We thought would be interesting to do some basic analysis on factors that affect the price of Bitcoins.

We considered three different stock market indices including Dow Jones Industrial Average (DJIA), Standard & Poors 500 Index (S&P 500), and Nasdaq Composite Index etc. For the purpose of this blog, we will use the S&P 500 to determine if Bitcoin prices are affected by the performance of the index over a period of time. While DJIA is one of the oldest, better known and frequently used indices it represents only about a quarter of the value of the entire US stock market. The S&P500 Index is a larger and more diverse index made up of 500 of the most widely traded stocks in the US and hence is a good indicator of the US marketplace sentiments.

We will use Data., an open, secure and social data collaboration platform in conjunction with IBM SPSS Statistics, a leading statistical platform to quickly and easily find insights in data. We will leverage a combination of stock/quote data with Bitcoin data hosted in a Data.World project (Sourced from bitcoincharts.com and uploaded as a Data.World dataset), collaborate with the team to identify areas of interest and deliver insights on how the performance of S&P500 (Sourced from Investing.com) affects the Bitcoin price.

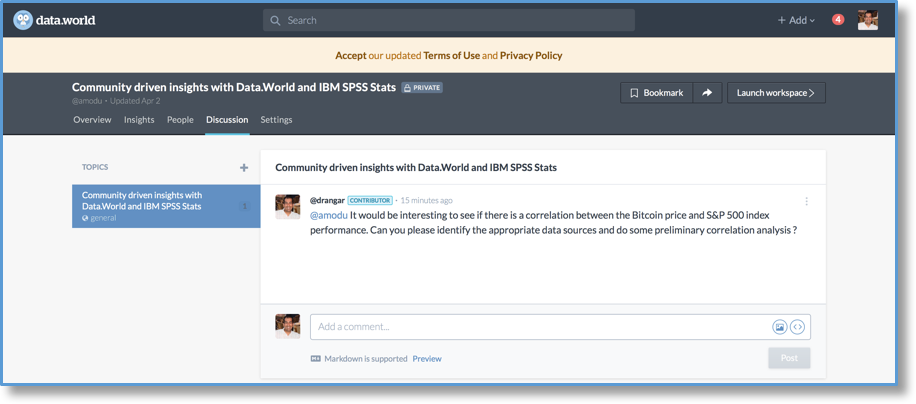

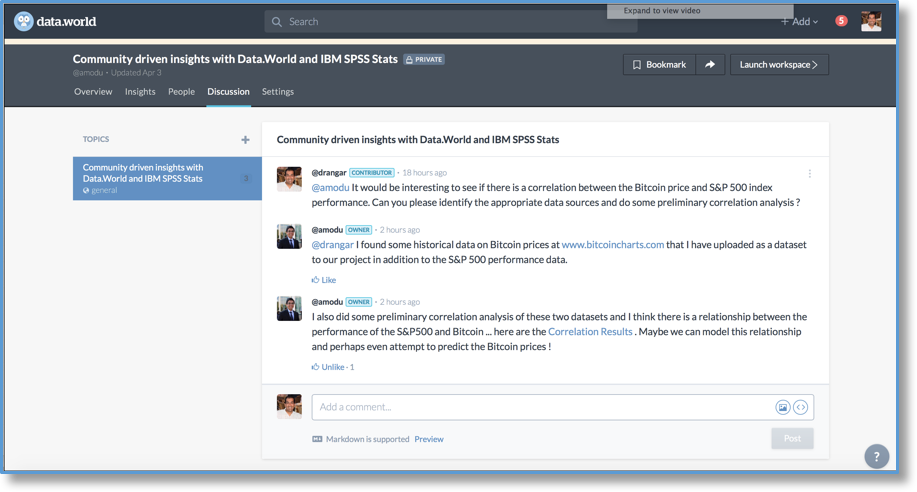

It appears that my colleague Deepak wants to do some research on how the performance of S&P500 affects the Bitcoin price.

Figure 1: Team collaboration with Data.World

Figure 1: Team collaboration with Data.World

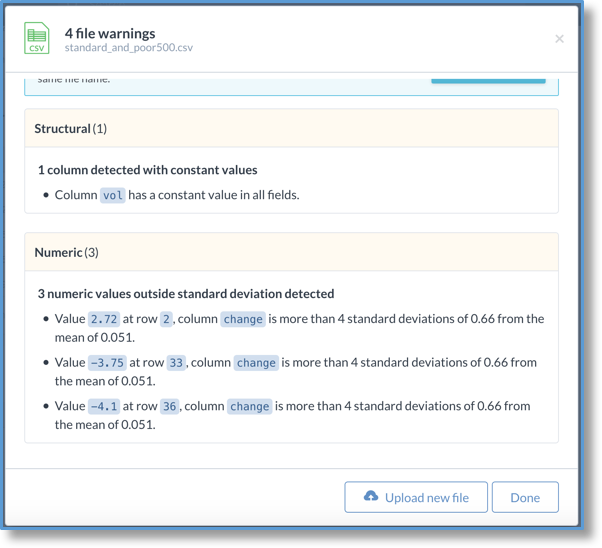

We will use the power of IBM SPSS Statistics integration with the Data.World platform and publish any insights we might get from the data. Upon uploading the data to Data., automatic data profiling was done and we were able to get a cursory view the data quality and outliers in the dataset as shown below.

Figure 2: Data profiling with Data.World

Figure 2: Data profiling with Data.World

We will now use the IBM SPSS Statistics extension for Data.World to import data into IBM SPSS Statistics and conduct our analysis. The Data.World extensions can be obtained from the IBM SPSS Predictive Analytics hub as shown below.

Figure 3: IBM SPSS Statistics Predictive Analytics Extensions

Figure 3: IBM SPSS Statistics Predictive Analytics Extensions

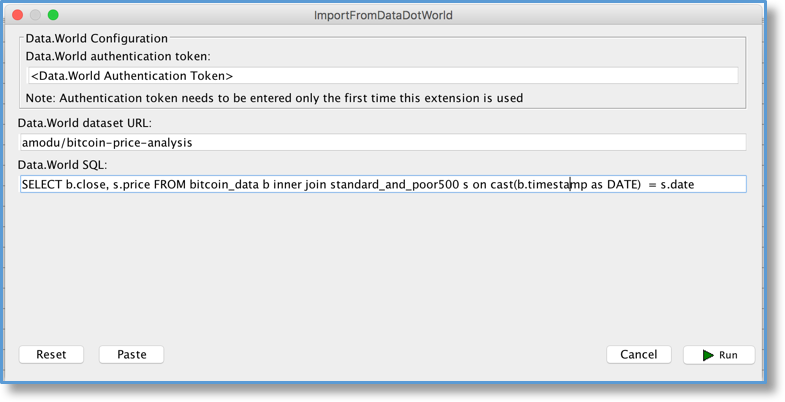

We are now able to access Data.World datasets from within IBM SPSS Statistics as shown below.

Figure 4: IBM SPSS Statistics extension for Data.World

Figure 4: IBM SPSS Statistics extension for Data.World

Importing data from Data. requires the following information:

- World authentication token from the Data.World settings page.

- Dataset name/URL of interest.

- SQL SELECT statement to access the data.

Figure 5: Data.World data import configuration

Figure 5: Data.World data import configuration

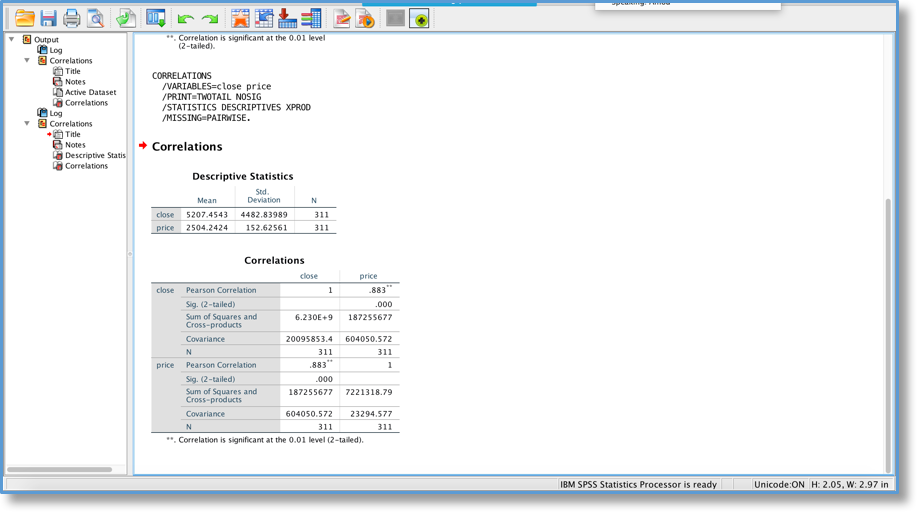

Now with the required data available for analysis in SPSS Statistics, I was able to run a quick Pearson correlation analysis (Analyze->Correlate->Bivariate) and the results were as below

Figure 6: IBM SPSS Statistics Pearson Correlation

Figure 6: IBM SPSS Statistics Pearson Correlation

It appears that there is a strong correlation between the S&P500 index and the Bitcoin prices. I think it would be idea to build a simple regression model (Analyze->Regression->Linear) that can help predict Bitcoin prices going forward.

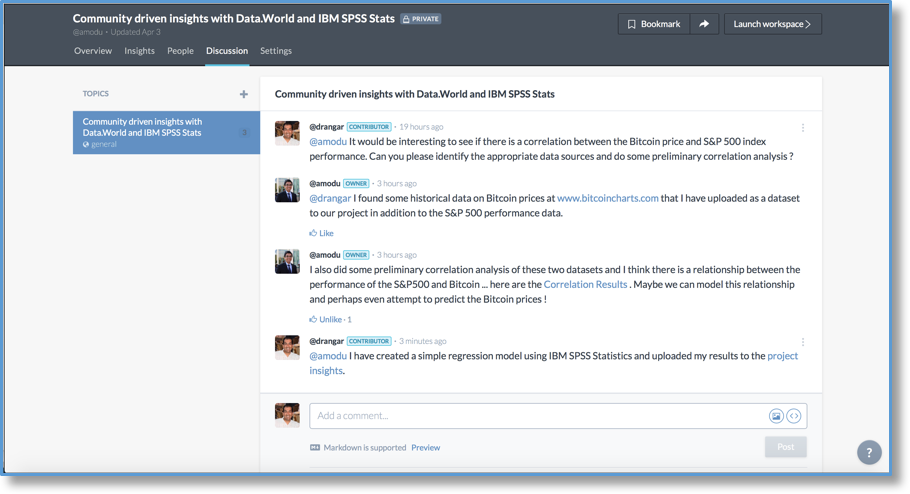

Figure 7: Data.World team collaboration

Figure 7: Data.World team collaboration

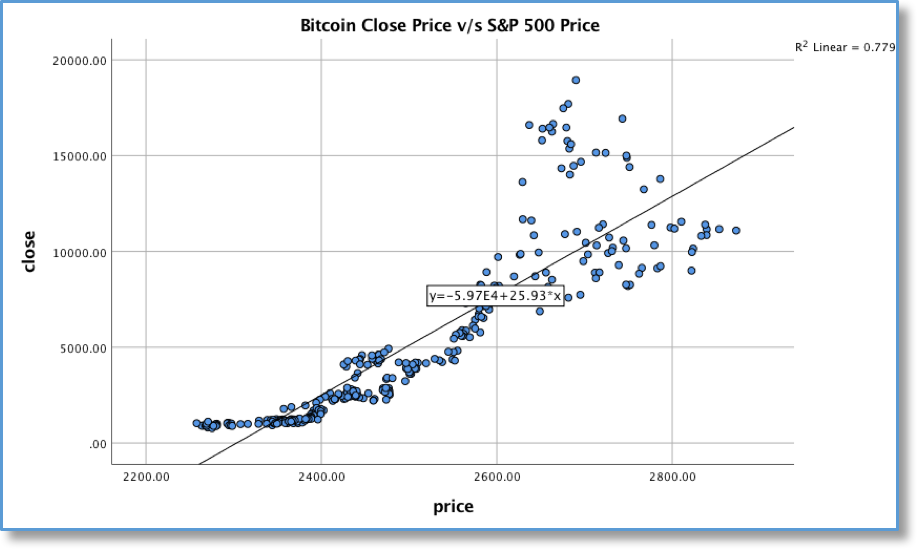

Figure 8: IBM SPSS Statistics Scatter Plot

Figure 8: IBM SPSS Statistics Scatter Plot

Figure 9: IBM SPSS Statistics Linear Regression Summary

Figure 9: IBM SPSS Statistics Linear Regression Summary

Bitcoin_Predicted_Price=-5.97E4+25.93*S&P500IndexValue

We are now able to leverage the coefficients from the IBM SPSS Statistics Linear Regression model to predict the Bitcoin price based on the different values of S&P500 as shown in the table below.

|

Date

|

S&P500

|

Actual Bitcoin price

|

Predicted Bitcoin price

|

|

02-Jan-2018

|

2,695

|

14,678

|

10,151

|

|

08-Feb-2018

|

2,581

|

8259

|

7,195

|

|

15-Mar-2018

|

2,747

|

8265

|

11,500

|

|

03-Apr-2018

|

2,609

|

7,464

|

7,921

|

Figure 10: Team collaboration with Data.World

#GlobalAIandDataScience#GlobalDataScience

Figure 10: Team collaboration with Data.World

#GlobalAIandDataScience#GlobalDataScience